The World's Largest Investment Community

Now every investor taking charge of their financial future can cut through the noise with peer-reviewed professional investment research from top analysts and rising stars in the asset management industry.

Now every investor taking charge of their financial future can cut through the noise with peer-reviewed professional investment research from top analysts and rising stars in the asset management industry.

SumZero Buyside's research is published exclusively by professional investors. No day traders, no sell-side analysts, 100% quality, peer-reviewed research from professionals at legitimate Buyside funds.

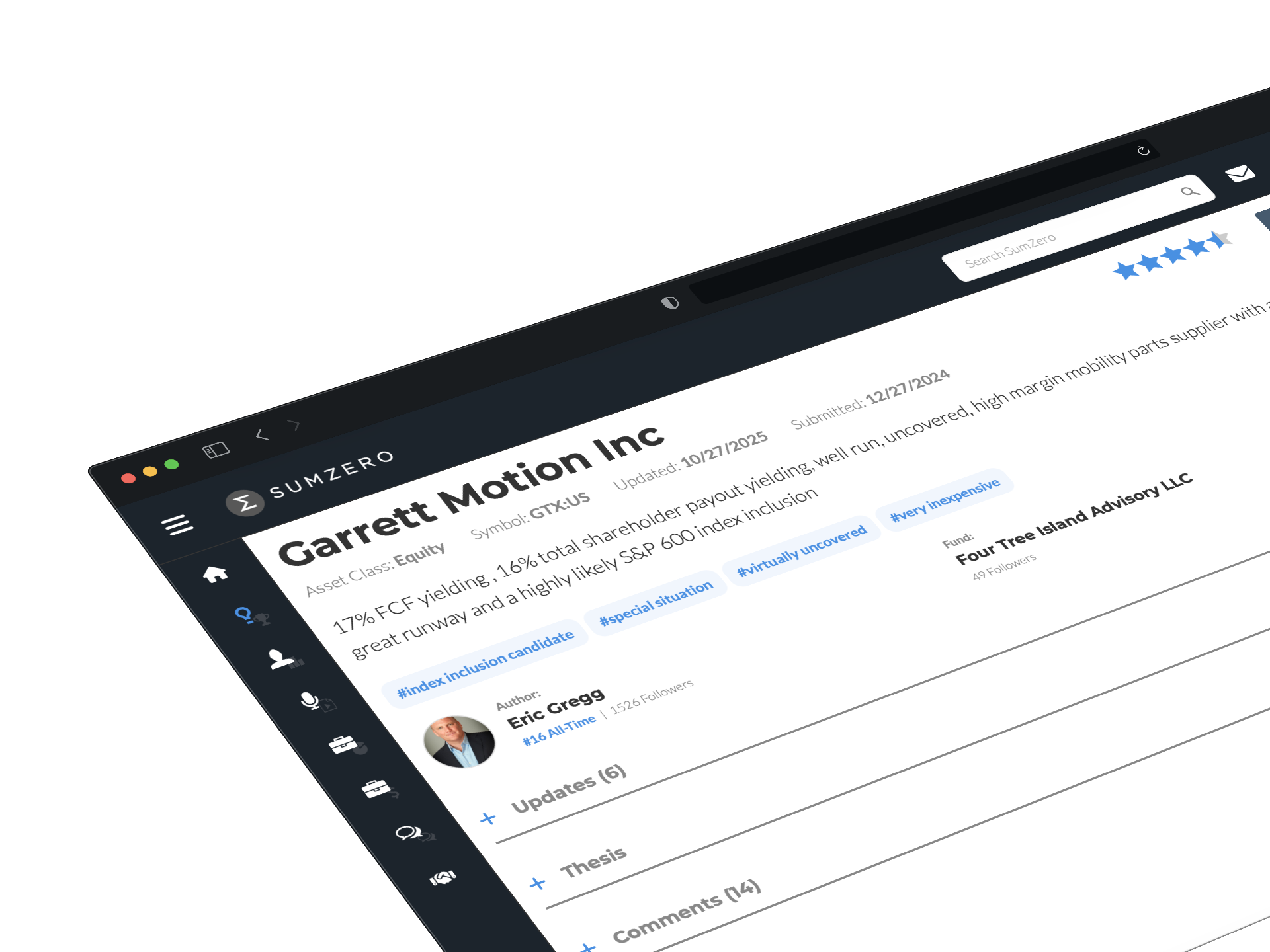

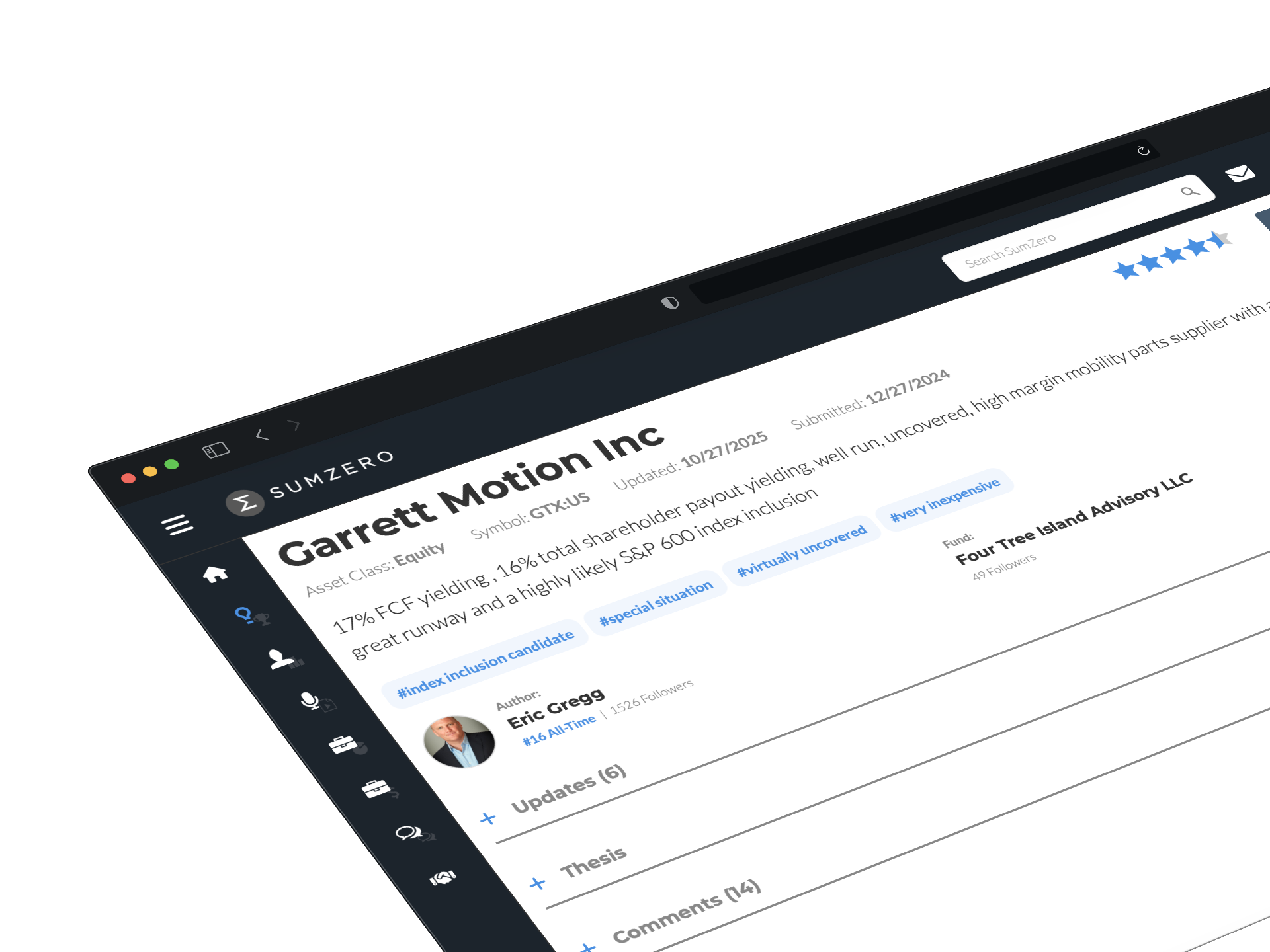

SumZero's research database is 100% comprised of actionable, peer-reviewed, long-form research from members of the hedge fund, mutual fund, and private equity fund analyst community. Research is 100% transparent, including analyst name, fund name, and disclosure status.

Research reports in SumZero are forward-looking with defined price targets, expected timeframes, valuation discussion, risk analysis, and catalyst review.

Unable to post firm research? Switch to a read-only license to access the research database and skip the posting requirement. A popular option for large funds and asset allocators.

No noise. SumZero brings unprecedented clarity to the research discovery process with powerful, robust, and comprehensive filtering.

Find the research that matters to you. Identify ideas with an extensive range of metrics including Market Cap, P/E, EV/EBITDA, as well as filters for catalysts, region, sector, and situation.

Save a search and let new research that matches your criteria be delivered directly to your email the moment it's published.

SumZero offers the world's only buyside analyst performance rankings system. Our proprietary Rankings algorithm examines the returns of individual investment recommendations made by thousands of fund analysts/PMs since 2008, and then identifies the individuals that have most consistently beat the market.

Rankings brings recognition to the most consistent alpha generators on the buyside using a methodology that is agnostic to pedigree, AUM, or seniority. Consistent benchmark out-performance on multiple recommendations is what you need to climb the Rankings ladder.

All SumZero Buyside members are eligible to get ranked on SumZero after submitting a minimum number of research ideas. Rankings lists are updated each month. All Buyside and Allocator members can access Rankings for free.

SumZero Rankings cover a variety of standard and proprietary categories, including: Long/Short, All-Time, LTM, Strategy, and many more.

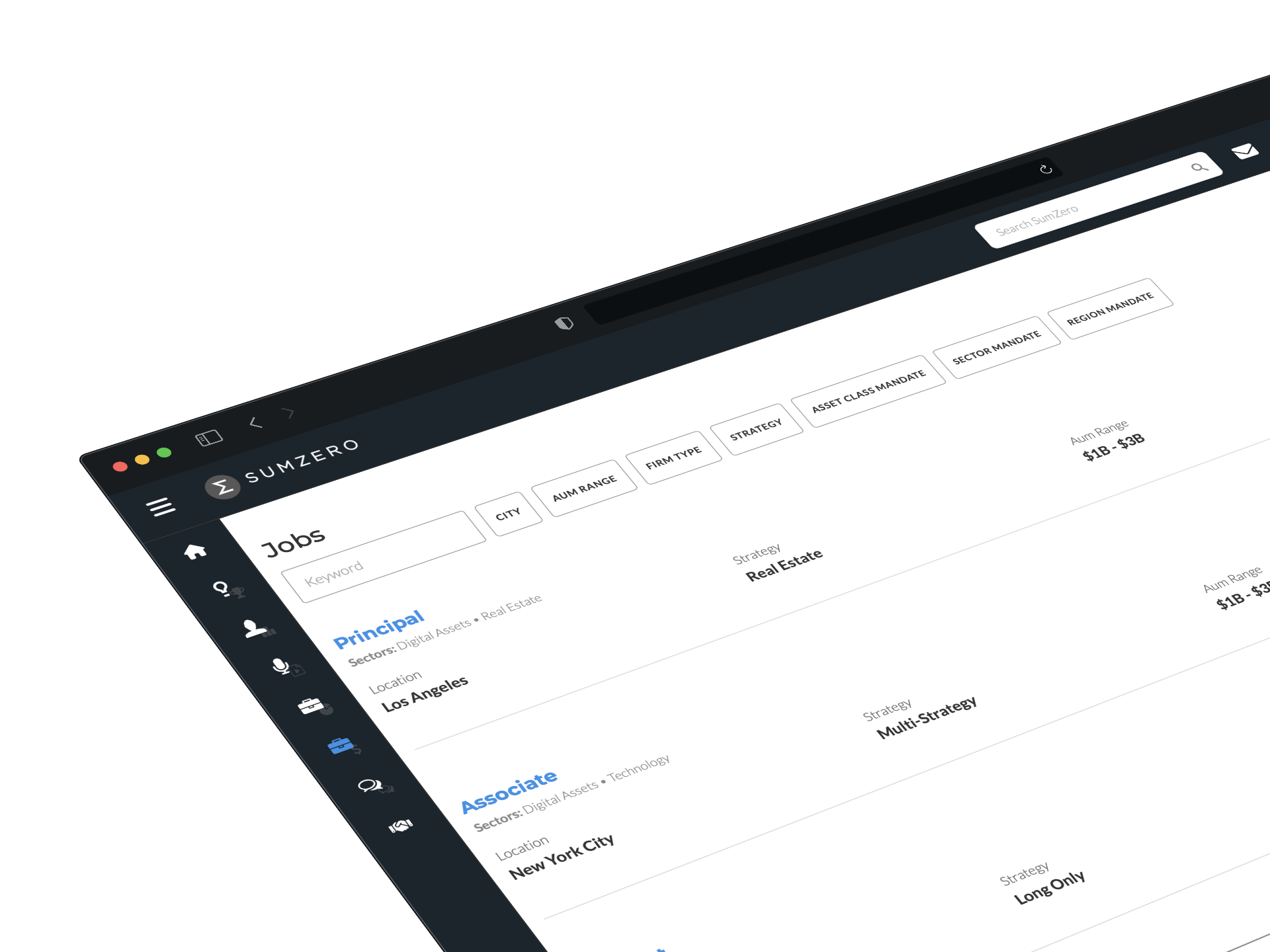

SumZero is the next step in buyside networking. Research you contribute on SumZero is tracked on a performance basis and allows you to build an independent track record.

More meaningful than just a resume and cover letter – SumZero gives you the added benefit of sending your top-performing research reports on the site along with your application directly to hiring managers at top global firms.

Are you making as much as your peers in the industry? Learn what fund professionals of all types earn with our 100% anonymous Compensation database, free to all members.

Smartly segmented by salary, bonus structure, carry, and other bonuses, as well as job title, location, experience, and several other metrics to give you a reliable picture for whatever role you're curious about.

When you contribute your compensation, it can never be traced back to your name or your employer. The Compensation database is the only anonymous database on SumZero.

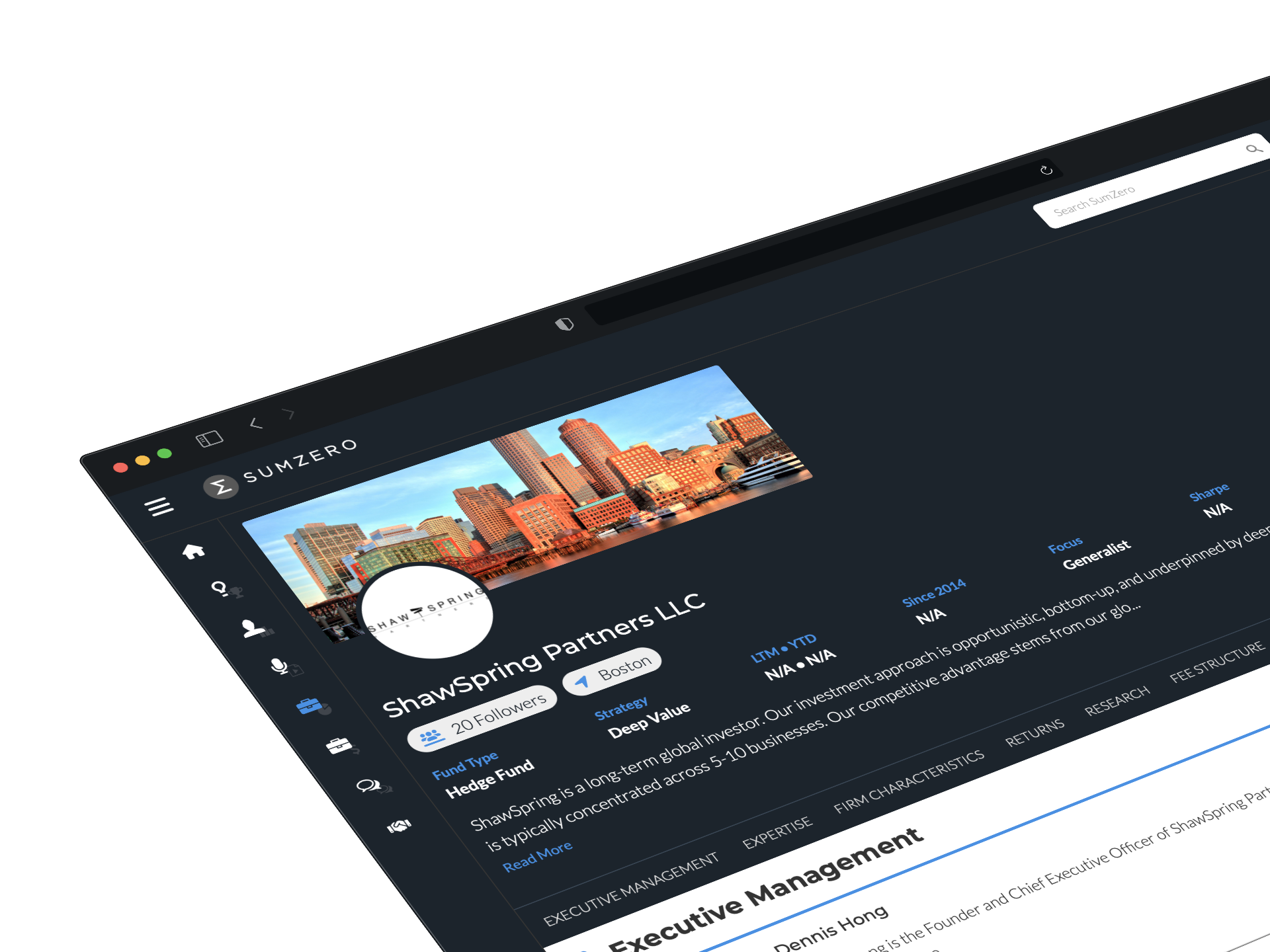

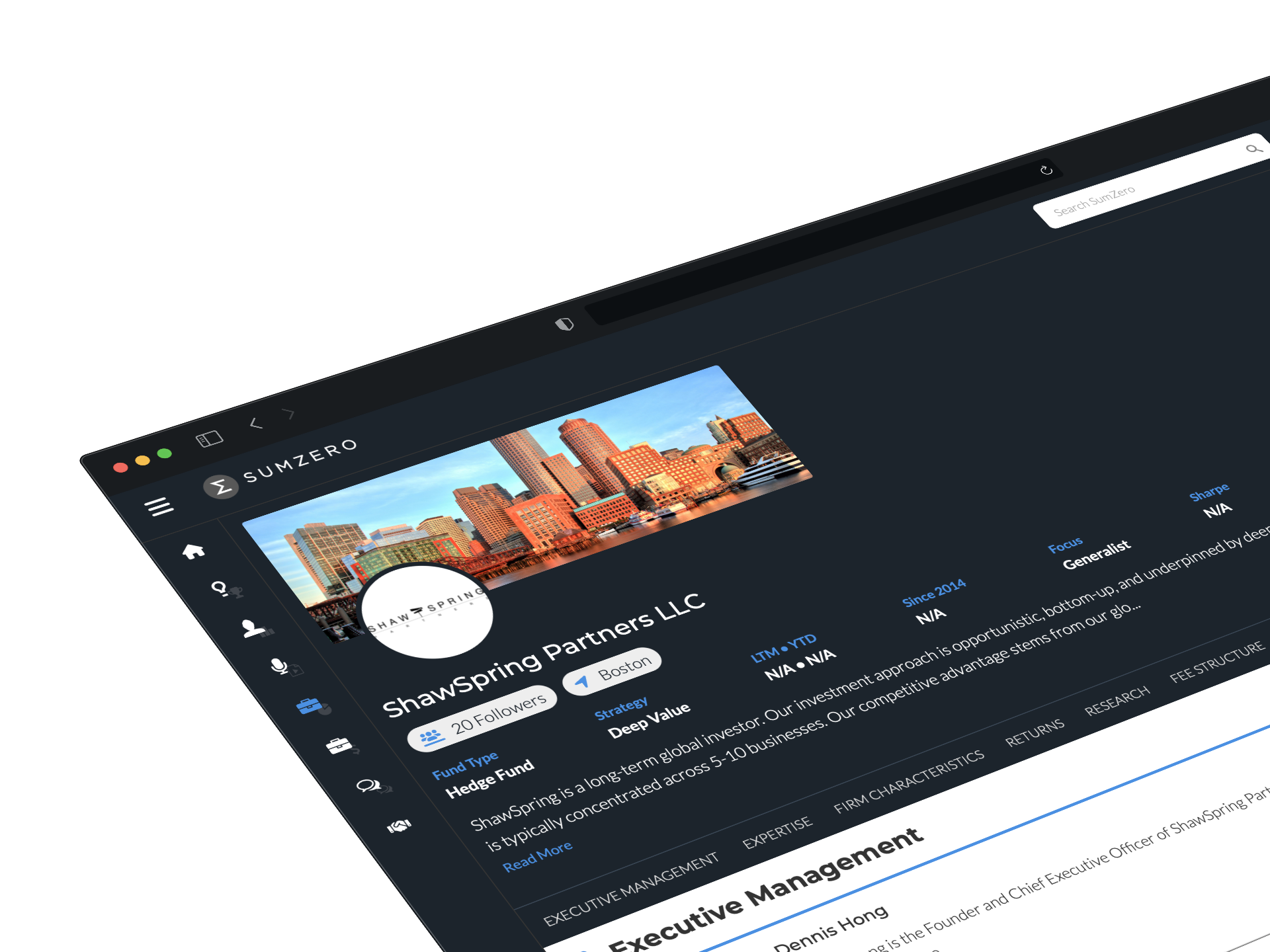

Tired of constantly explaining and re-explaining the details of your fund to disinterested or unqualified investors? SumZero's Cap Intro program puts the essential information of your fund in front of hundreds of pre-qualified institutional allocators in a passively managed, reverse-solitestimonial format. From returns to firm references to investor letters to your proprietary research on SumZero, all your materials are neatly contained in one protected page.

Show allocators why your fund is different. Remove barriers to your documents and data, and present the full picture of your expertise, process, performance, and infrastructure.

Experience broad exposure to a high-quality group of investors that are actively allocating to funds and can radically change the future of yours. Get matched with capital allocators who reach out to you based on the quality of your fund's page.

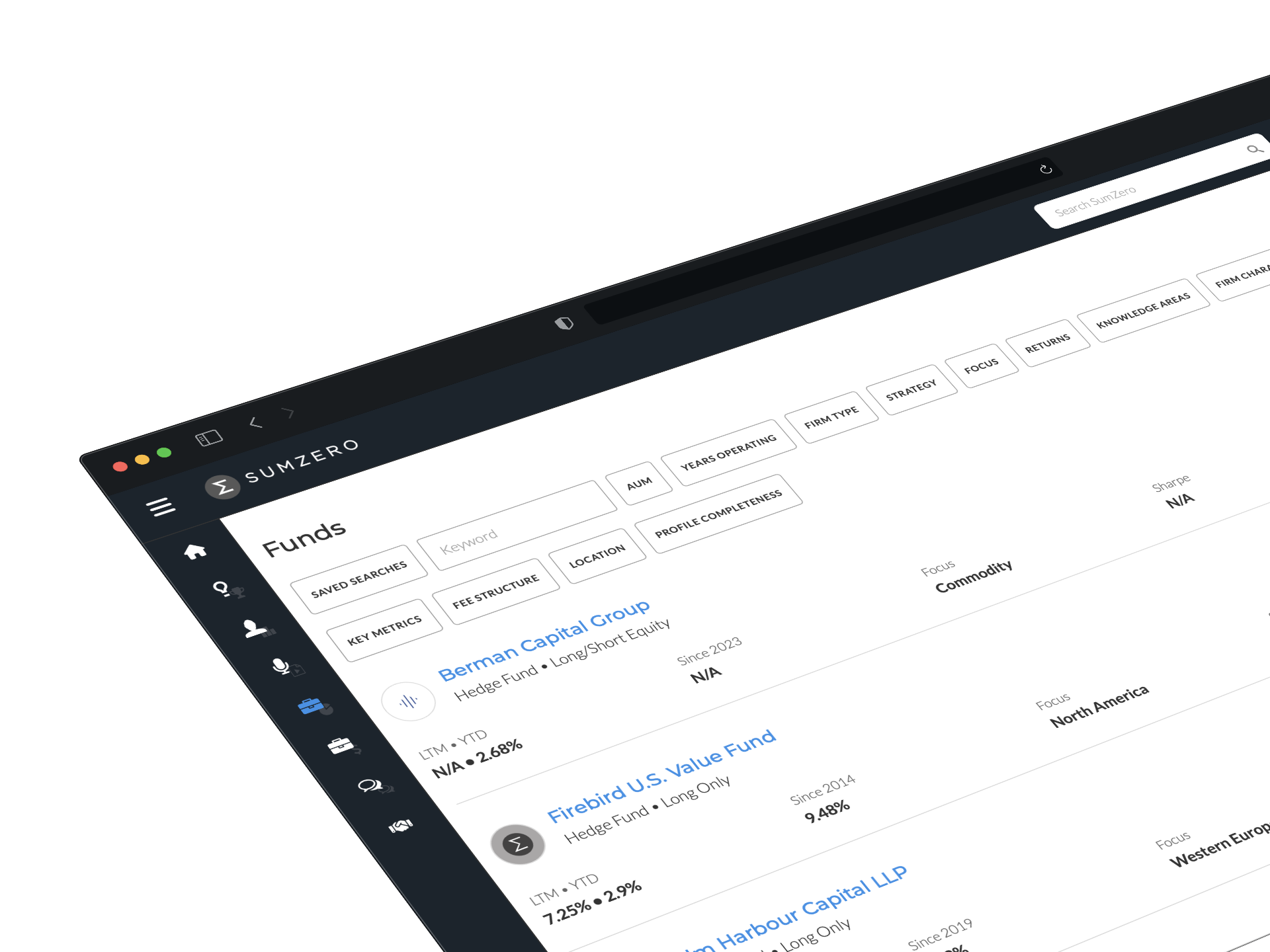

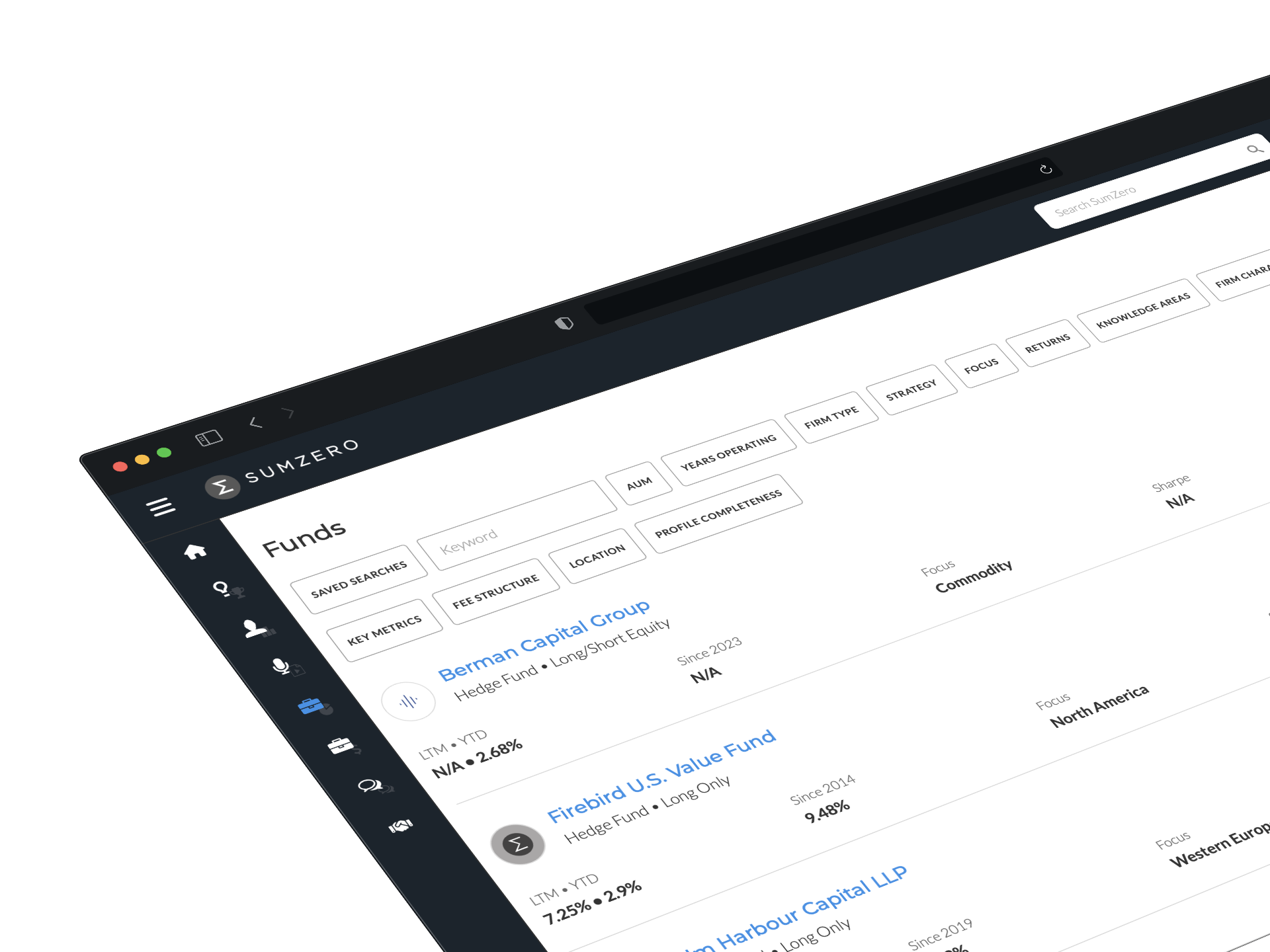

Finding a good fund is work... phone calls with fund managers can be exhausting and your inbox is often flooded with spam. SumZero Allocator was custom-built to address the needs of institutions looking to find unique funds which match the particulars of all investment mandates without adding to the problem.

Browse and view hundreds of funds on the SumZero Cap Intro platform. Remove friction from the due diligence process with unrestricted access to all documents. Passively track, filter, and create email alerts for funds of all types.

You are guarded from spam. Your name and contact information are never displayed on the site, and never made available to members without your explicit permission. SumZero Cap Intro is a reverse-solitestimonial database.